A cash flow hedge may be designated for a highly probable forecasted transaction a firm commitment not recorded on the balance sheet foreign currency cash flows of a recognized asset or liability or a forecasted intercompany transaction. A Non-Designated Agency real estate firm owes a duty of loyalty to a client which is shared by all agents of the firm.

Commodity Hedging Lessons Learned By Early Adopters Of New Hedge Accounting Rules Opportune Llp Jdsupra

With a unique set of microchannel condensers an experimental comparison between subcooling generated in non-designated area NDA and designated area DA of the condenser showed that both configurations yielded similar values of maximum COP improvement within the operating ie 2 conditions considered.

. Mar 26 2004. Lets see the difference between Root Port and Designated Port. Recognition and Measurement is often criticised as being complex and rules-based thus ultimately not reflecting an entitys risk management activities.

A single selected port on a switch other than root switch. Non-derivative financial instruments measured at fair value through profit and loss are also allowed for hedging FX risk. Derivative instrument not designated as hedging instrument under Generally Accepted Accounting Principles GAAP used as economic hedge for exposure to risk.

The designated port is the port on every switch rootnon-root switch. A fair value hedge may be designated for a firm commitment not recorded or foreign currency cash flows of a recognized asset or. In this particular case the son was a designated beneficiary and the charities were non designated beneficiaries so the executor would have no authority to request account changes.

On the other hand a Designated Agency firm appoints a particular agent to a client. 12 The main changes in the IFRS 9 hedge accounting requirements Hedge accounting under IAS 39 Financial Instruments. From time to time to hedge our price risk we may use and designate equity derivatives as hedging instruments including puts calls swaps and forwards.

If the company has a designated fair value hedge where the hedged item is taxed in line with its accounting treatment the tax treatment of the derivative is to simply. In hedging activities in both financial and non-financial services entities. In the Job Details area on the right side of the page click on your Position.

The results suggested that the way. Designated preliminary spots are spots for people going into subspecialties. Carefully practiced or designed or premeditated.

Derivatives are designated as hedging instruments which meet the criteria of hedge accounting except some written options. Accounting for currency basis spreads 17 5. Integrated plastics programs also require 3 years of.

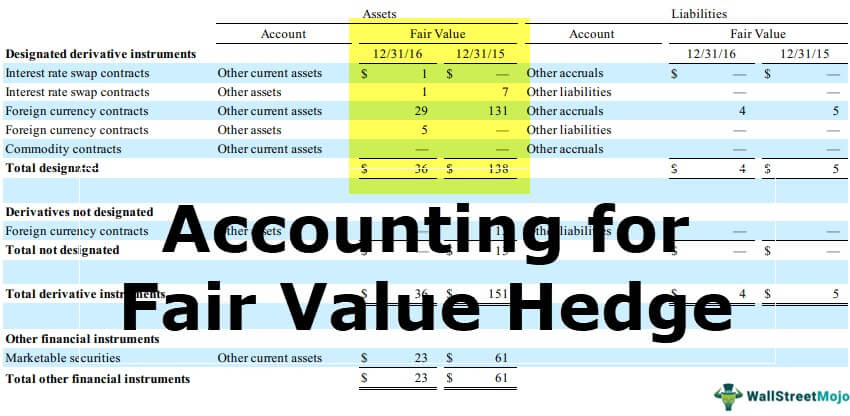

ENT Ortho Urology Neurosurgery all require 1 year of internship in general surgery. Designated Fair value hedge. As adjectives the difference between designed and designated is that designed is created according to a design while designated is having a specified designation.

- The deductibles and copaymentspayment percentage listed in the schedule of benefits below reflect the. As of June 30 2012 the total notional amounts of designated and non-designated equity contracts purchased and sold were 14 billion and 982 million respectively. A vehicle designed for rough terrain.

The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting. A not designated beneficiary is a classification for certain nonperson entities who inherit a retirement account. This is incorrect unless the estate was the IRA beneficiary.

A magnet is surrounded by a configured field. Non-derivative financial instruments are continued to be allowed for hedging only FX risk. 3 a new accounting standard that.

In the Additional Information on the right side of the page your Additional Job Classifications will show your emergency event status designated or non-designated Managers can change designations in Workday by doing a Change Job and editing the details tab. Its pretty straight forward and very easy to understand. Organized so as to give configuration to.

In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting hedges. Non Designated Hedges Our derivatives not designated as hedging instruments from ACC 201 at Trident University International. - Non-designated network coverage we mean you can get care from network providers at the higher cost share.

And ongoing monitoring of. These are designated preliminary spots because they are only for people going into these subspeciallities. Lowest STP cost on a particular local area network LAN segment to the root bridge.

Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any of its Subsidiaries is a party and as to which a Lender or any of its Affiliates is a counterparty that pursuant to a written instrument signed by the Administrative Agent has been designated as a Designated Hedge Agreement so that the. These nonperson entities are subject to different withdrawal. 1 the substantial cost of documentation and ongoing monitoring of designated hedges.

IFRS 9 contains no restrictions regarding the circumstances in which a derivative can be designated as a hedging instrument provided the hedge accounting criteria are met except for some written options. On the other hand a Designated Agency firm appoints a particular agent to a client. - Designated network coverage we mean you get care from network providers at the lowest cost share.

Not Designated as Hedging Instrument Economic Hedge. Non-derivative financial instruments measured at. Planned or conceived in detail or for a specific purpose.

Not Designated as Hedging Instrument Trading. 2 the availability of natural hedges that can be highly effective. Not Designated as Hedging Instrument.

Least path cost from a non-root bridge to reach the root bridge. And if the estate had been the beneficiary instead while the executor could assign the IRA out of the.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Accounting For Fair Value Of Hedges Examples Journal Entries

Back To Basics Hedge Accounting

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Derivatives And Hedging Accounting Vs Taxation

Measurement Of Financial Instruments Ifrs 9 Ifrscommunity Com

Classification Of Financial Assets Liabilities Ifrs 9 Ifrscommunity Com

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

0 comments

Post a Comment